Stop Repeating the Same

Costly Trading Mistakes.

Connect Your Favorite Brokerage

Find Out Why You Keep

Losing Money.

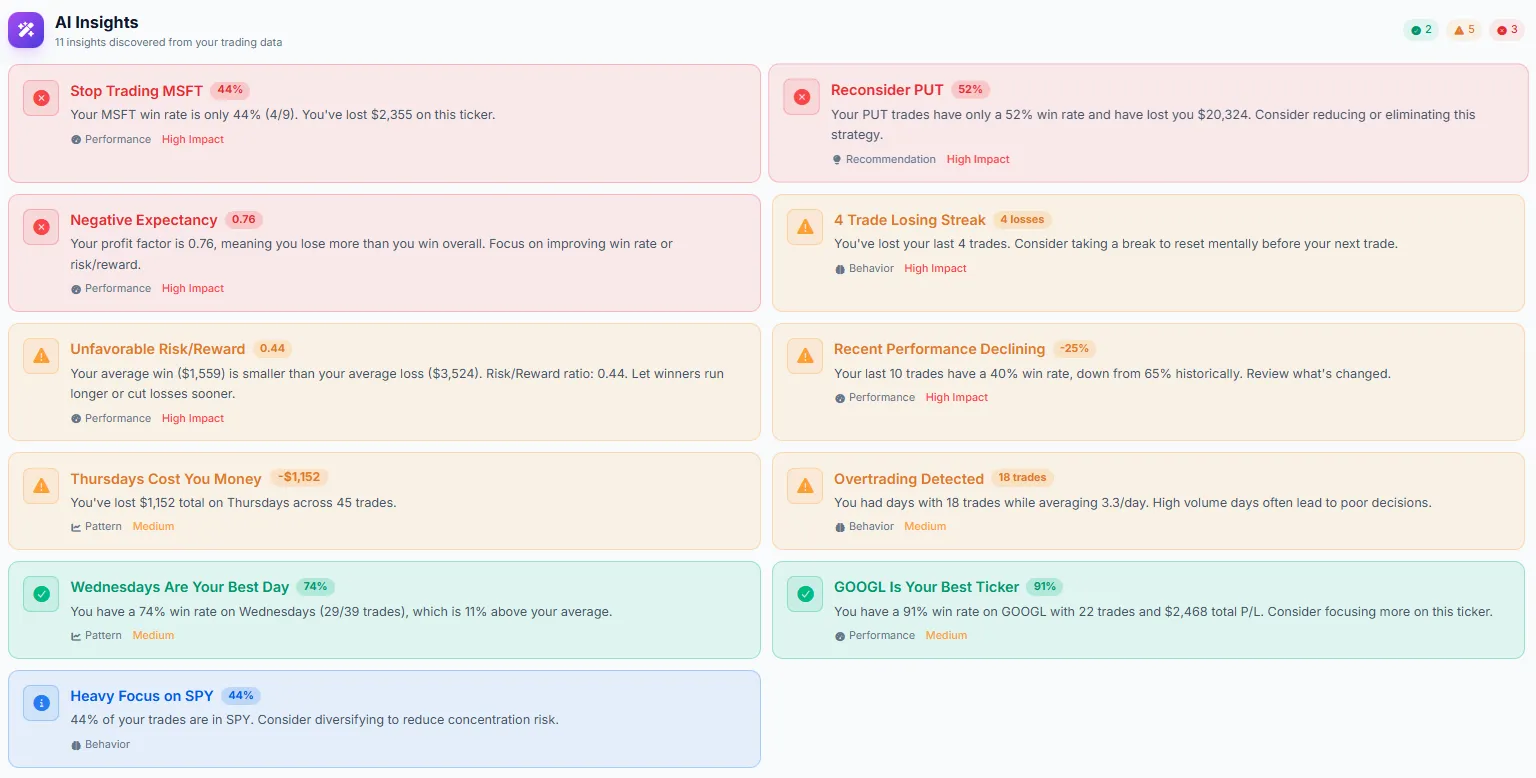

You're making the same mistakes over and over — you just can't see them. Our AI analyzes your complete trade history and exposes the patterns that are quietly draining your account.

- Days & times you should STOP trading

- Tickers & strategies draining your account

- Revenge trading & overtrading warnings

- Losing streaks you didn't notice

Your Monday win rate is only 34%, which is 20% below your average.

78% win rate with $2,450 total profit across 45 trades.

You hold losers 3x longer than winners. Let your winners run!

Built for Every Stocks & Options Strategy.

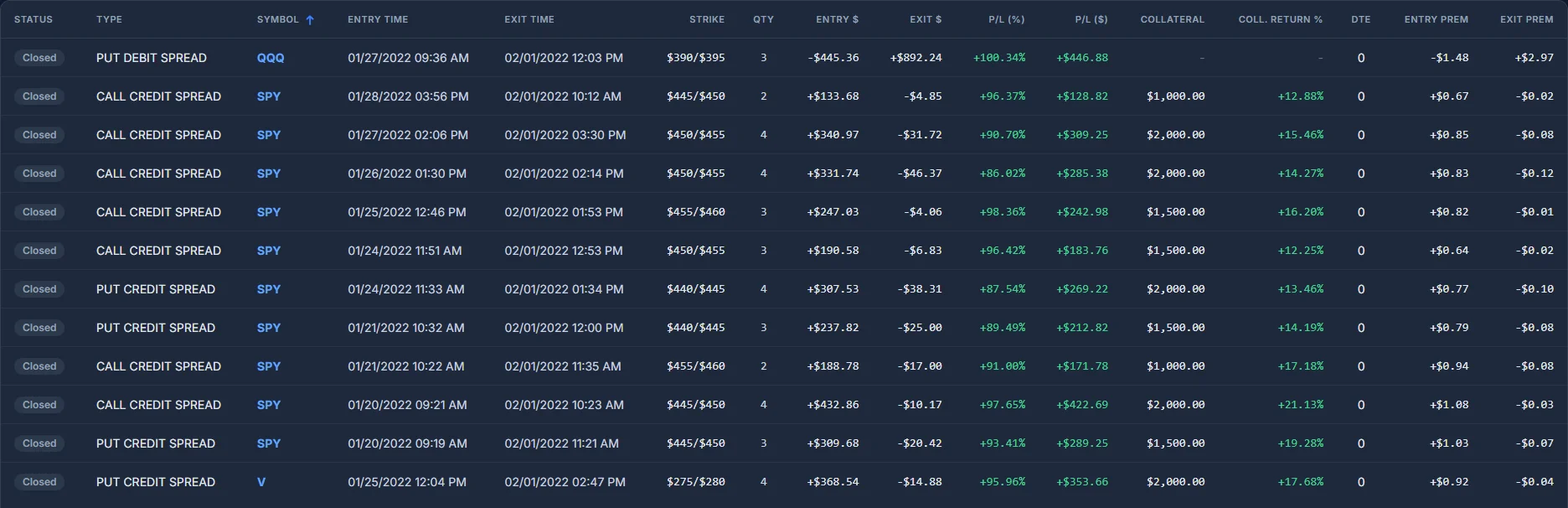

Your broker doesn't tell you your real risk. We do. Automatically filter your trades by strategy type (Iron Condors, Spreads, Covered Calls) and see your exact Collateral Usage and Return on Risk.

- Credit Spreads, Covered Calls, Iron Condors, Straddles & more

- Track Collateral Risk & % Gain per trade

- Filter P/L by specific strategies

Stop Trading Blind.

See What's Costing You.

Your broker hides the data you need. We expose exactly where your money is going — and why.

P/L Calendar

Visualize your daily performance with a beautiful heatmap calendar. Identify your best days and spot streak patterns.

- Daily, Monthly, Yearly Views

- Profit/Loss Heatmap

Advanced Filtering

Isolate what works. Filter by ticker (SPY, GOOGL), strategy (Iron Condor, Vertical), or date.

- Custom Metric Filtering

- Strategy Tagging

Deep Analytics

Real-time calculation of your Win Rate, Profit Factor, Expectancy, and more.

- Equity Curve Graph

- Performance Metrics

Frequently Asked Questions

How much does it cost?

Try our free demo first to see all features in action. When you're ready, choose from monthly, yearly, or lifetime access. View our pricing!

Is my data secure?

Absolutely. We use secure OAuth authentication - the same technology used by major banks. Your credentials are never shared with or stored by us.

Do you support options and stocks?

Yes! We support both options and stock trading. For options, we track strikes, expirations, and complex multi-leg strategies.